Decoding

complexity.

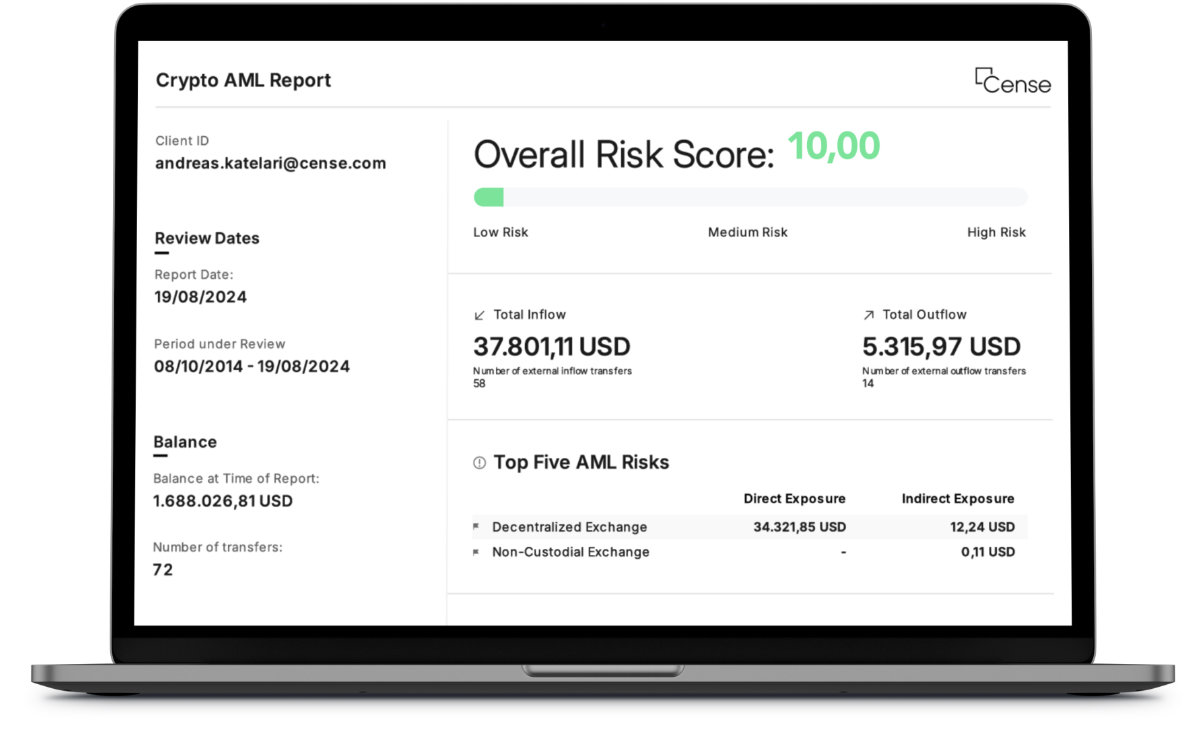

At Cense, we simplify and automate the compliance journey in an ever more complex financial world. Adhering to AML/CFT rules, we help enable the quick, accurate, secure assessment of investors’ digital assets – minimising risk and enhancing efficiency.

From collecting data to analysis and reporting, we have it covered. We surface and clarify the information that financial institutions need to see, so compliance teams can make the most informed decisions

Our comprehensive reports are fully substantiated and entirely transparent, ensuring that digital asset holders are seen for who they are, and are able to transfer their digital assets, effortlessly, confidently and confidentially.

Clear, auditable

reporting that works

in the real world.

Cense gives you the insights and documentation

you need to make informed compliance decisions

quickly and accurately.

Key features

of Cense.

The Cense difference

Automated due diligence – in one convenient report.

Risk scoring

Assess and score the risk profile of digital asset holders to ensure compliance and minimise risk.

Source of funds

Track the source of the funds behind each Blockchain transaction.

Automatic counterparty analysis

Analyse the counterparties to transactions to identify and mitigate potential risks.

On-chain screening of sanctions and high risk jurisdictions

See digital asset holders’ direct and indirect exposure towards sanctioned on-chain entities and funds – and understand exactly where they are doing business.

Source of wealth

Check and confirm the origin of asset holders’ wealth to blockchain, meet stringent regulatory rules.

Proof of wallet ownership

Obtain reliable proof of wallet ownership to establish legitimacy and enhance trust.

Hidden wealth indicator

Know when an asset holder has declared all their funds or whether they’re attempting to conceal funds, wallets or exchanges.

Data standards

Complete data security and compliance with GDPR and SOC2 certification standards.

How it works:

Complexity, decoded.

Compliance, empowered.

Register.

Send your crypto owner a link and they’ll receive a co-branded email to register with Cense.

Connect.

Step-by-step navigation guides them to connect their wallets, exchanges and crypto history to our platform.

Report.

In approximately 15 minutes youʼll receive a comprehensive PDF report confirming the crypto owner’s asset sources, wallet ownership and risk profile.

Review.

Quickly and easily review our consolidated summary of their entire blockchain history; not just a single wallet.

Decide.

Make an informed decision aligned to your risk appetite and informed by a customised risk score.

Your questions,

answered.

Got a question? Ask away. You’ll find answers to our most commonly asked questions right here, whether you’re a digital asset holder, or are in compliance or asset management at a bank. If you can’t find what you’re looking for, feel free to talk to one of our experts.